. . brings a decentralized and democratic economic platform to the real economy!

. . brings a decentralized and democratic economic platform to the real economy!

While housing affordability remains one of the biggest obstacles for many in most countries, it's more so for the Millennial and Gen X generations in developed countries where real estate is used extensively as the wealth creator to push inflation and growth.

It's over 10 years since the world was engulfed in the GFC because of housing prices spiraling out of control, mainly fueled by institutions and the FOMO ( fear of missing out ) in people who ultimately became part of the mixture for that failure - the way FOMO can easily come about can be seen by the escalating property prices in many of the same countries, just as before - again the prices are being incentivized by the low interest rate loans offered by the banking institutions using money that's not been linked back to real productivity in economies.

In all this wealth creation pushed along by the more affluent groups who gained from the earlier growth periods during the previous decades, the unfortunate casualties have been the younger generations who have found themselves to be over educated and under capitalized to even contemplate getting into the property markets, and even behind with the higher rents that get carried by the higher property prices.

Cloudfunding offers a solution for Millennials, Gen Xs and others who have been unable to afford buying their first home - unlike banking where the business model is selling a loan product to a buyer in return for payment and interest over time - Cloudfunding offers the economic environment and neutral digital interaction between Sellers and Buyers for free, with no marketing costs, no listing fees or agent fees - the property is listed by Sellers at a validated and fair market price and the Outsourced Selling takes the property to the Global Crowd to process.

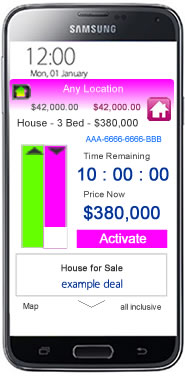

The disadvantages placed in front of the younger generations and others that find themselves behind the curve is solved when the Global Crowd establishes the low Buying Prices at 20% of the Selling Prices - again Price Demand is activated, even from a mobile, with the full Selling Prices cascading down until a Buyer accepts the price - this simply means that a Buyer pays the price for the home they want, then they own the home out-right, with no loans or debts - eligibility is only available to local Buyers and those who qualify as First Home Buyers ( owner / occupier ).

Owner / Occupiers wanting to move from house to house are eligible to use the platform to list their existing house and/or bid for a new house with much more predictability over a shorter time frame.

A democratic Global Crowd takes on the mortgage lenders

The Global Crowd have a self-interest in ensuring that affordable housing is available for everyone - the failure of the financial and real estate industries in maintaining stable and affordable housing prices and rentals has raised its ugly head with inflated housing prices quite quickly in most developed, and even in the developing countries with distorted prices - not only by easy lending but by allowing auction type selling to feed right into providing the atmosphere to bid up the price rather than negotiate down from fair market prices.

The involvement of the Global Crowd with Direct Foreign Decentralized Capital - DFDC ensures the Sellers the market price that they instigate, and is further supported by the Global Price Index - GPI for the real estate industry - the real demand is supported when the property is released with Price Demand and Activated by potential local Buyers.

Price stability is a key factor

Traditionally the real estate market moves up and down with prices that get influenced by supply, demand and the health of local and global economies - and it can be a terrifying outcome to those holding mortgages on property when prices begin to decline - the way that First Home Buyers platform operates is that the market prices ( GPI ) achieved across the general market in any location, are maintained indefinitely as the Selling Prices, regardless if there's an incremental or sudden fall in prices - this means that the home owners wanting to sell will be able to use those prices previously achieved before any market price decline, as their home's Selling Price.

Maintaining market prices is achieved because of the way Cloudfunding is structured on an autonomous global scale using an Open Market environment with Price Demand, without being linked to the Old Economy where Bank lending and mortgages are involved.

Cloudfunding operates within specific guidelines of never allowing credit or debt to be part of any Supply and Demand ( binary - 0 and 1 ) interactions and is governed to only operate with validated neutral international trading units of account held by Buyers and Sellers in the Global Crowd to complete any trade.

The New Economy is the digitization and democratization of the flow of trade through Global Trade and Commerce using the digital means of tracking neutral international units of account, which in some ways is the digitizing of what the IMF has with SDR - a restricted Special Drawing Rights value ( a foreign-reserve currency also termed as XDR that replaces gold and US Dollars ) - which countries can draw down at various costs to exchange between trading countries to balance trade surpluses and deficits - what the New Digital Economy does with Cloudfunding, and in particular with DFDC - Direct Foreign Decentralized Capital, is it modernizes the limited use of SDRs by fully democratizing trade, removes the incumbents and opens up global economies to free open markets with a ubiquitous flow of a neutral international trading unit of account value, which the people of the world and countries control and operate with, in real time within the real economies.

Co-Ops can be used by Buyers and Sellers

First Home Buyers can organize a Buyer Co-Op to help in the buying when a home becomes available that they would like to own. With the Co-Ops the members can pool their efforts together in first bidding for the various homes and then combining together to try and buy when the Price Demand is ready to activate.

New house construction can use the First Home Buyers offer just like existing homes - in new construction a builder can offer projects to first home buyers by listing a project before construction and have the construction fully paid for via the Outsourced Selling process - with the funding held in escrow prior to releasing the homes on the Open Market for local home buyers to activate the Price Demand - once a buyer wins the deal and construction begins, the funds are released to the builder during construction for the full value of each stage - builders can use the Seller Co-Ops to work together with suppliers to streamline and benefit from more predictable and profitable sales.

Contact

Privacy Policy

Terms of Service